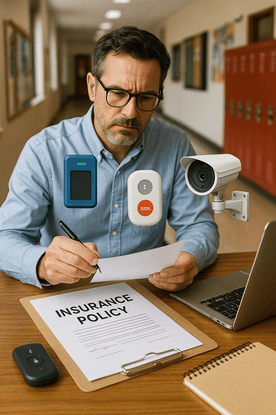

If you’ve ever renewed your school’s insurance policy and felt a twinge of sticker shock, you’re not alone.

Premiums are rising across the board for K–12 campuses, and insurance providers are taking a hard look at risk exposure—especially when it comes to school safety and security systems.

Here’s what they’re really looking for:

✅ Systems that reduce liability

✅ Evidence of prevention

✅ Technology that shows you’re proactive—not just reactive

The good news? The right security tech can actually work for you—protecting students and staff while helping control your insurance costs.

Let’s break down the security upgrades insurance providers love to see and how they directly impact your school’s risk profile.

k

k

1. Access Control Systems That Track Who Comes and Goes

If your school still relies on physical keys or a sign-in sheet, it’s time for an upgrade. Modern cloud-based access control systems let you:

-

Instantly revoke credentials for terminated staff

-

Restrict access to certain areas during specific times

-

Keep a digital log of every entry and exit

-

Lock or unlock doors remotely in emergencies

From an insurance standpoint, that means tighter perimeter control and proof of due diligence in access management—two major factors in risk evaluation.

j

j

2. Integrated Emergency Alert Systems That Speed Up Response

When an emergency happens, your response time matters—and insurance carriers know it.

Schools that have mobile panic buttons, mass notification systems, or lockdown automation in place are often seen as lower risk because they’re equipped to handle a crisis quickly and systematically.

This is especially true in states that have implemented Alyssa’s Law, which requires silent panic alert systems in schools.

j'j

j

3. Video Surveillance with Time-Stamped Footage

Cameras aren’t just about catching misbehavior—they’re your evidence archive.

If a liability claim is made—whether it’s a trip and fall or a safety incident—clear, time-stamped video can be the difference between a costly settlement and a quick resolution.

Insurance carriers want to know that your system:

-

Covers entrances, hallways, and high-traffic zones

-

Stores footage securely and reliably

-

Can be reviewed remotely when needed

k

k

4. Documented Drills and Digital Safety Reports

Having safety technology is great. Proving that it’s used is even better.

Smart schools are now using digital platforms to log:

-

Safety drills (fire, lockdown, weather, etc.)

-

Emergency system tests

-

Incident reports with time and location tags

This documentation shows insurers (and regulators) that your school takes safety seriously—and it can help in audit or claim investigations.

k

k

5. Proactive Maintenance and Remote Monitoring

One thing insurers really don’t like? Outdated or ignored systems.

Using a security integrator like SSP means your access control, video surveillance, and alerts are:

-

Monitored 24/7

-

Updated with the latest firmware

-

Routinely tested for functionality

-

Maintained with minimal downtime

All of this translates to lower risk of failure, which lowers the odds of a costly incident or lawsuit.

k

k

Bottom Line: Safety Tech That Saves More Than Lives

The right security systems do more than protect your campus—they protect your liability profile.

And in today’s risk-averse insurance market, that can lead to:

-

Lower premiums

-

Favorable policy terms

-

Smoother claims processes

-

Stronger position during renewal negotiations

At SSP, we don’t just install safety tech—we help schools build a strategy that satisfies IT, admin, facilities, and yes—even insurers.

k

k

Ready to strengthen your campus security and reduce your insurance exposure?

Let’s talk about the upgrades your underwriter actually wants to see.

👉 Schedule a security consultation